European Energy Markets:

TTF, NBP ready to move higher. EUAs, German power may decline

The Dutch TTF and British NBP natural gas hubs are set to move higher early this week. This is in alignment with the bullish sentiment benchmark.

German power markets, on the other hand could start out weak before buying sets in in the €84 – 85/MWh region. This is implied by bearish stochastic and a bearish reversal candle near key resistance on the daily chart.

EUAs also look weak this Monday morning with a corrections kicking in below €91.73/tCO2e. Carbon emissions certificates have formed two consecutive bearish candles on the daily chart that set the market up for a decline towards the channel support near €87.50/tCO2e.

Dip buyers may be waiting for a trough on the EUAs and German power towards the second half of this week.

Get the full weekly analysis with actionable TTF insights directly to your inbox for free. Click here.

TTF Front Month gas outlook

- The bulls continued to push higher with another sharp rally on unusually strong volume seen last Friday, reflecting strong bullish conviction as expected.

- Fib retracement levels have been refreshed to include the new recent high again.

- Trend and momentum tools are now broadly in line with in-house algos, pointing to a higher likelihood of further upside.

- The recent volatility spike is a stark reminder that one must not be complacent during periods of low volatility and take on outsized positions. Low-volatility periods are exceptionally prone to such vol spikes.

- For now, a more likely break above €38.06/MWh (R1) would keep the bull trend intact and strong toward the last peak at €42.44/MWh (R2).

Watch the full weekly analysis video here.

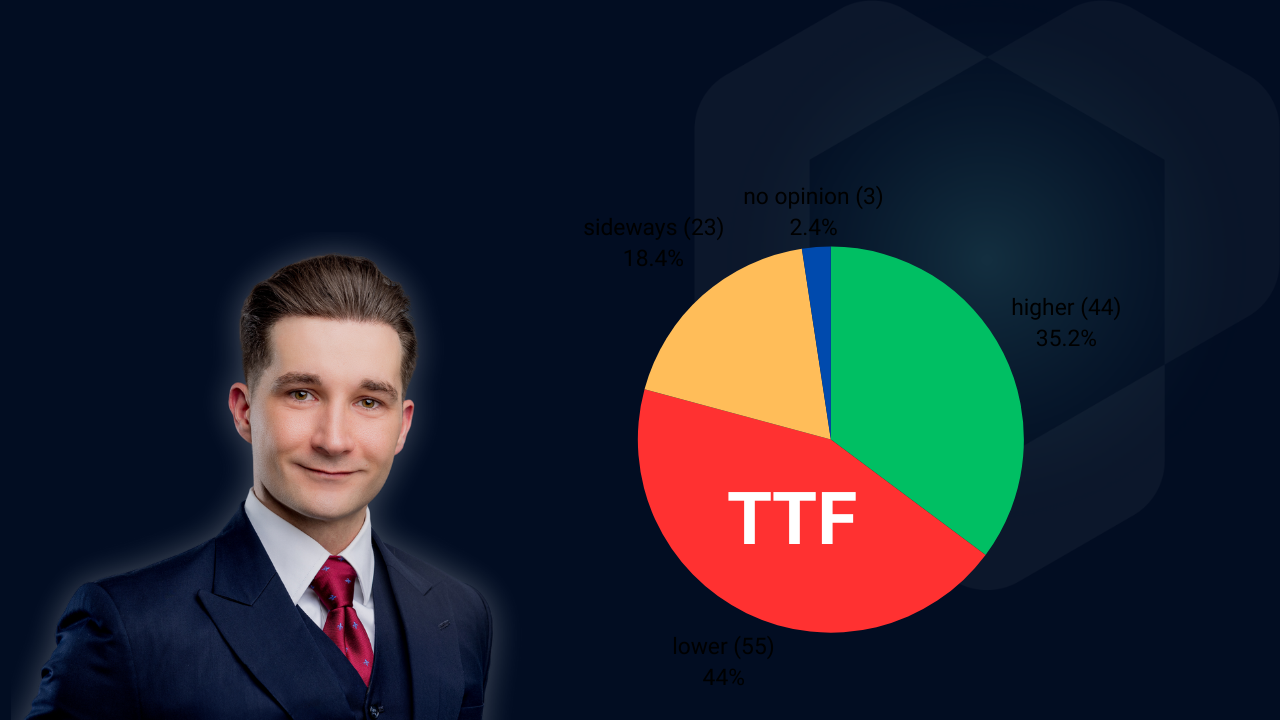

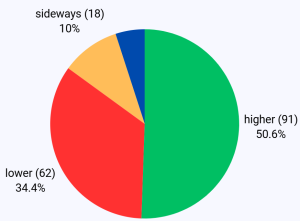

TTF Sentiment Benchmark

The TTF sentiment benchmark switched from 44% bearish dominance a week earlier to 50% bullish dominance this Monday.

Over the past few weeks, our quants have correctly identified that the benchmark predictions were not going to work out. When the sentiment was firmly bearish, the market went up and vice versa.

This week, however, the charts are in alignment with the bullish sentiment. We might see a strong open this week.