European Energy Markets:

TTF, NBP, German Power and EUAs ready to continue lower

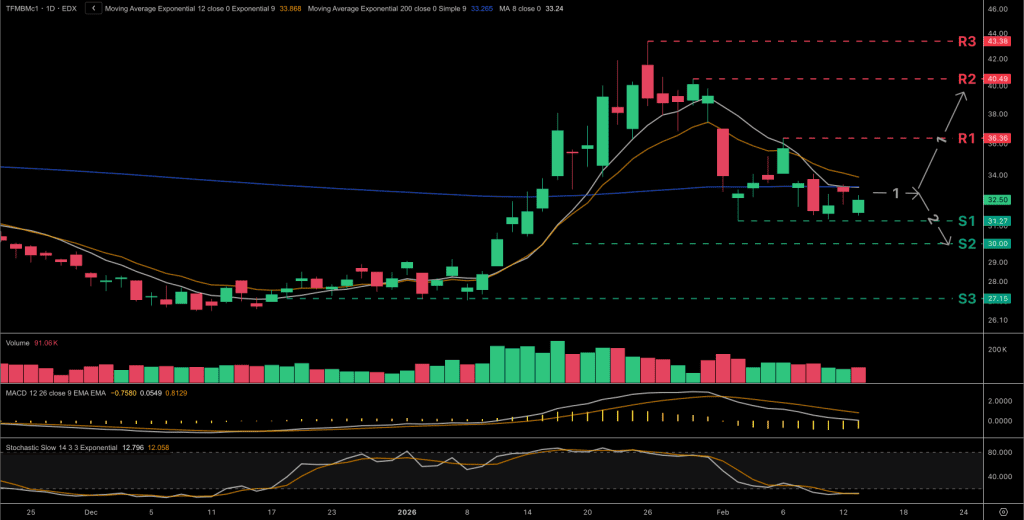

The Dutch TTF front month natural gas contract ended with a bearish setup in a sideways range last Friday. A move lower to test the €31.27/MWh range support seems plausible this Monday. If buying sets in there, a move to at least €36.36/MWh is in the cards. NBP futures also looks ready for a weak open this Monday. A move below 74.06p/th is needed to kick off a decline towards at least 70.76p/th.

Until these key levels break, however, spec trading opportunities are very limited. We really want to wait for the market to make up its mind. There is no benefit in over-committing to a trade idea right now.

The German Power bears had a blast last week. Two long red candles saw prices decline by €4.35/MWh. Our tools suggest more losses this week. Even our alternative scenario is only a correction higher before losses continue.

This is good news for physical players overall. Some buyers may choose to get some volume now in case we get an extended upside correction towards €80.60/MWh, which is our alternative scenario.

Our EUA analysis has been bang on for the longest time. We even nailed the €72/tCO2e downside target with the Maerz’s announcement to potentially loosen carbon obligations. Our proprietary quant algos suggest more losses this week towards €65.25/tCO2e. That inverted hammer we saw last Friday may not lead to a massive recovery.

Get the full weekly analysis with actionable TTF insights directly to your inbox for free. Click here.

TTF Front Month gas outlook

- A sideways range between €31.27 – 36.36/MWh (S1-R1) is likely to persist for some time.

- With a weak bear trend in a nontrending regime, spec plays are best avoided.

- The market is stabilising without directional clarity. The longer this stabilisation cluster forms, the more likely an eventual rebound can be seen.

- A break above the last peak at €36.36/MWh (R1) would give affirmation of the recovery.

- However, tools are increasingly bearish and a further downtrend continuation may still be plausible as well.

- A fall below the last trough at €31.27/MWh (S1) would likely see the psychological level at €30/MWh (S2) being tested next, where strong dip buyers may reemerge.

This is the shortened free version available to newsletter subscribers. Contact us to get access to the full dashboard that includes alternative scenarios, multiple timeframes, trigger levels, quant signals, pattern backtests and much more.

Watch the full weekly analysis video here.

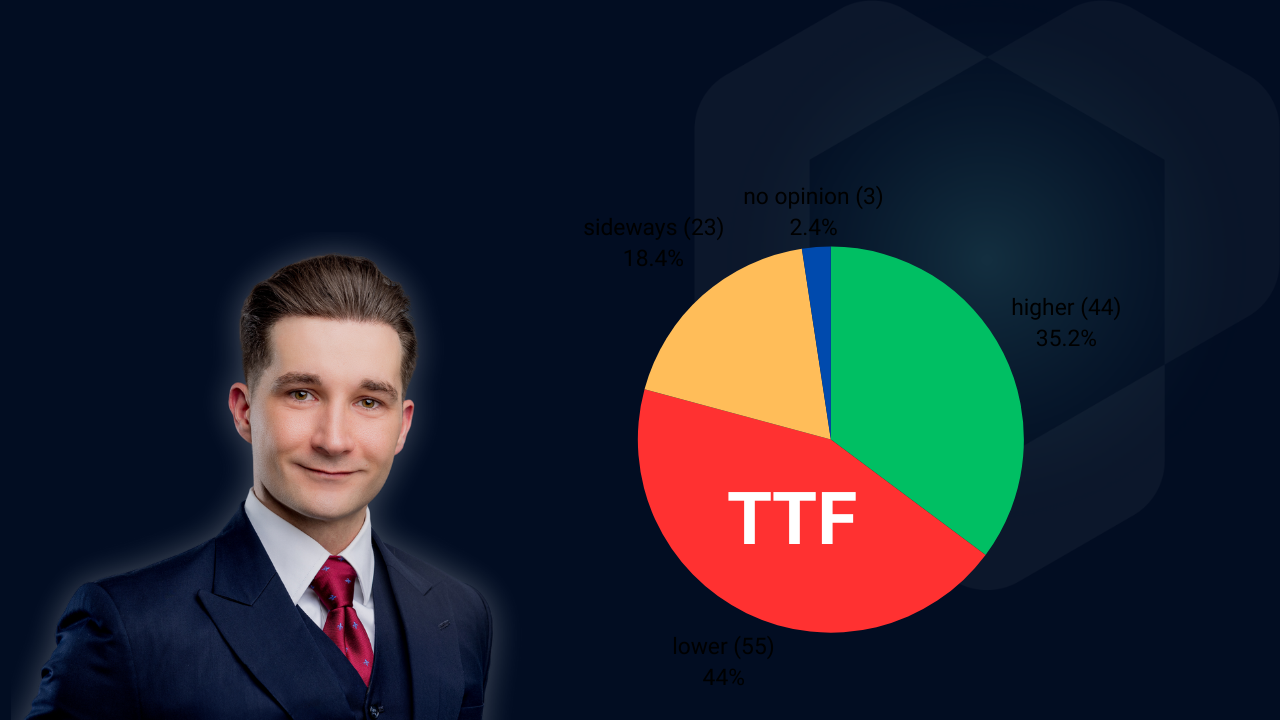

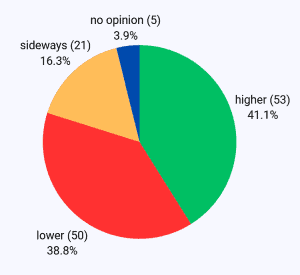

TTF Sentiment Benchmark

For the third week in a row, the TTf front-month bulls and the bears remain reasonably balanced in our sentiment benchmark. This suggests normal trading continuation.

No short squeeze or long covering expected of any sorts.

This balanced approach for the Dutch natural gas market makes sense as price is still hovering sideways in a clearly defined range of €31.27 – 33.39/MWh.

Want access to the benchmark history? Contact us to get started with Clever Markets.