European Energy Markets:

Just a dip, if the bulls don’t panic

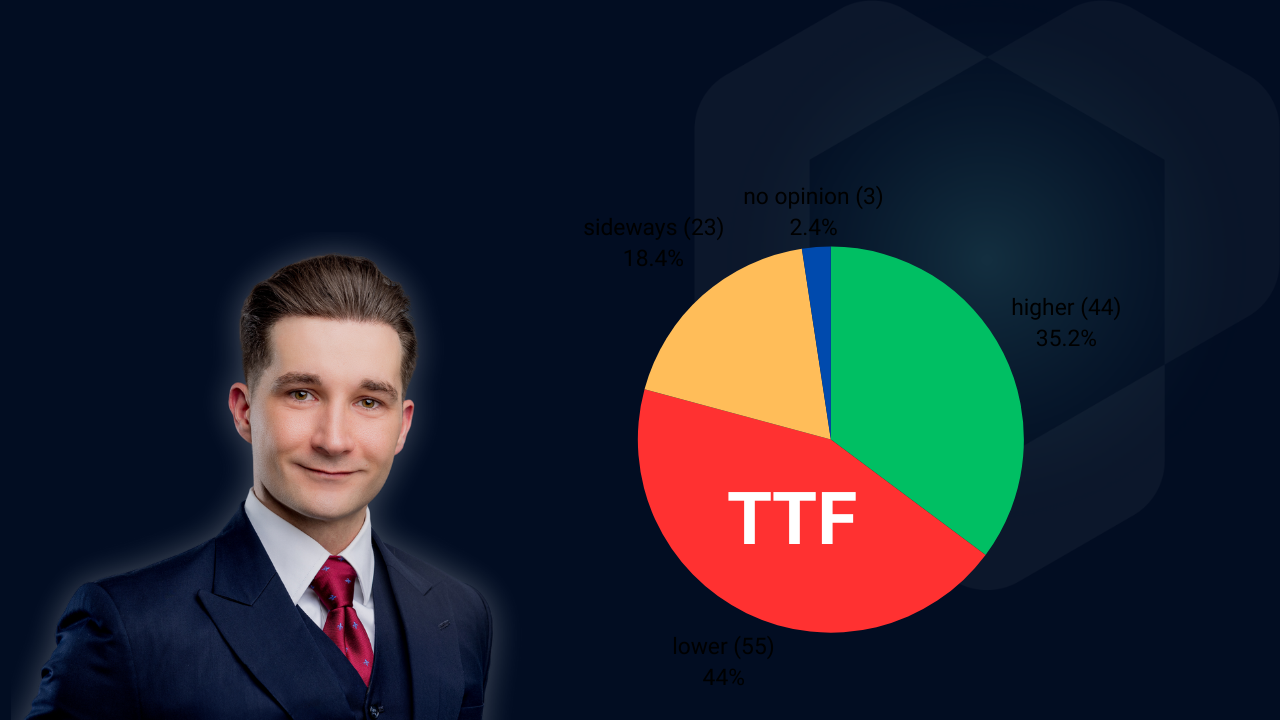

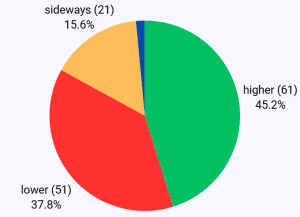

Here we go again. We are now faced with the exact same situation we had a few times this year so far. The bulls hold a small majority on this Monday’s TTF sentiment benchmark. But the energy price chart is set up for a small decline this morning.

This means that even a small price drop this morning could freak out the bulls. Long covering could then fuel a deeper downleg.

But if the bulls remain reasonable, our preferred scenario remains as follows:

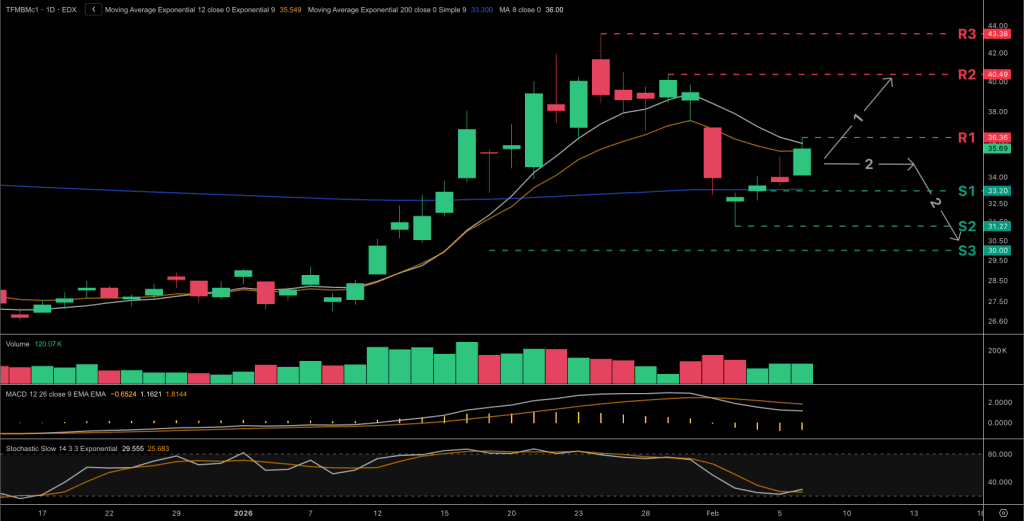

Although we are expecting a soft open for the TTF front-month on Monday morning, buyers may step in near €34.10/MWh with prices for the Dutch natural gas hub ready to bounce towards €36.76/MWh afterwards.

The algo outlook has softened toward neutral and advises caution. So don’t expect massive trend-following moves. Our quants at Clever Markets see the market stabilising without directional clarity. Spec plays are best avoided.

German power markets seems more ready to immediately continue higher this morning without much of a correction first.

On the EUA chart we expect an immediate strong open towards €80.70/tCO2e before prices decline again.

So in short, we might see a lot of confusion this morning:

- TTF and NBP down, then up

- German power: up

- EUAs: up, then down

- Henry Hub: down

This is not going o be fun.

Get the full weekly analysis with actionable TTF insights directly to your inbox for free. Click here.

TTF Front Month gas outlook

- The market has pushed firmly above the 200-day EMA, establishing a short-term bullish context last Friday.

- Given recent trough above the 200-day EMA, a break above €36.36/MWh (R1) looks more likely and would open the way for a test of the next resistance at €40.49/MWh (R2).

- The 200-day EMA at €33.20/MWh (S1) now provides solid support beneath prices. Speculative traders may look to trade this corrective upleg on lower-level charts, while physical traders may begin to position ahead of a move above €36.36/MWh.

- Nonetheless, the algo outlook has softened toward neutral and advises caution. The market is stabilising without directional clarity. Spec plays are best avoided.

- The longer this stabilisation cluster forms, the more likely an eventual rebound.

This is the shortened free version available to newsletter subscribers. Contact us to get access to the full dashboard that includes alternative scenarios, multiple timeframes, trigger levels, quant signals, pattern backtests and much more.

Watch the full weekly analysis video here.

TTF Sentiment Benchmark

The bulls dominate the sentiment benchmark for a second week in a row. But it is unclear how willing the bulls are to hold on to their conviction, should the market dip lower slightly this morning.

Want access to the benchmark history? Contact us to get started with Clever Markets.