European Energy Markets:

Dip buyers beware

Some traders on the TTF front-month and NBP front-month natural gas contracts might be looking for dip buying opportunities near the lower end of their respective sideways ranges. But dip buyers beware.

Although the price charts are still looking reasonably bullish, our in-house quantitative algos are warning us that we have entered a transition phase in the energy futures markets.

On the TTF, for example, this could mean a move below the range support at €37.14/MWh towards the deeper downside target at €33.29/MWh. A move lower is the preferred scenario.

Should the TTF price drop below €37.14/MWh, an initial scramble to close out the newly established long positions would only fuel any downleg on the Dutch natural gas markets. The same applies to the British NBP gas market.

German Power contracts and European carbon markets are also ready to move lower, according to our classic chart reading methodology and proprietary trading algorithms.

Get the full weekly analysis with actionable TTF insights directly to your inbox for free. Click here.

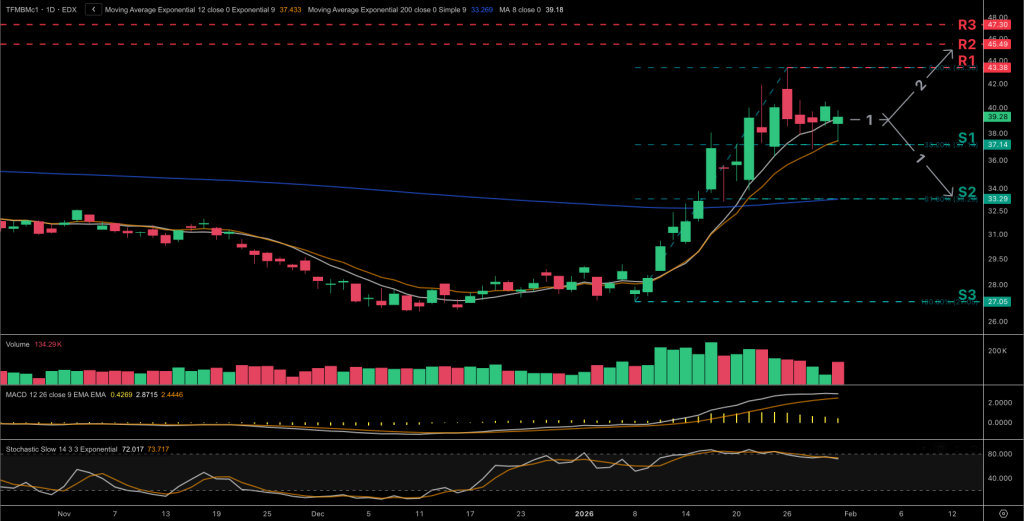

TTF Front Month gas outlook

- With the bull trend still strong, the 38.2% Fib retracement at €37.14/MWh (S1) is a key support that may see some dip buying supporting the sideways consolidation.

- In-house algos however suggest the market is entering a reversal zone despite the strong trend regime, limiting upside potential and making a corrective pullback the preferred scenario.

- A break below €37.14/MWh (S1) would likely trigger long covering toward the confluence support at €33.29/MWh (S2), where the 61.8% Fib retracement aligns with the 200-day EMA.

- Traders are advised not to chase the rally while some may look to fade strength near €43.38/MWh (R1) or on hourly timeframe.

This is the shortened free version available to newsletter subscribers. Contact us to get access to the full dashboard that includes alternative scenarios, multiple timeframes, trigger levels, quant signals, pattern backtests and much more.

Watch the full weekly analysis video here.

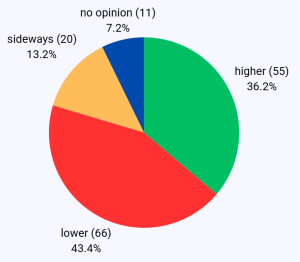

TTF Sentiment Benchmark

The TTF front-month sentiment benchmark moved from slight bearish dominance to slight bullish dominance. But overall the picture remains mixed with strong opinions on both sides.

This is in line with the sideways range we are currently working through on the daily TTF daily chart. Prudence is recommended for now.

But once we break past the range, the move might be swift, with half the market scrambling to adjust their expectations.

Want access to the benchmark history? Contact us to get started with Clever Markets.