European Energy Markets:

Gas and power futures ready to move lower

The Dutch natural gas market, the British NBP and German power markets are all set to move lower early this week. The energy price charts are all signaling bearish setups near key resistance areas.

The TTF sentiment benchmark is also aligned with losses. Once the market starts ticking lower, some bulls will be forced to close out their longs. This would fuel the initial downleg further.

Whether or not a weak open on Monday morning will lead to a full bear trend on the daily charts is uncertain. But each energy market is working with a clear bearish validation level.

Our in-house trading algorithms reveal that the European carbon emissions market is still caught in a non-trending regime. The bull trend is weak and the daily candlestick chart is prone to mean reversion. Trading opportunities are restricted to the hourly chart.

Get the full weekly analysis with actionable TTF insights directly to your inbox for free. Click here.

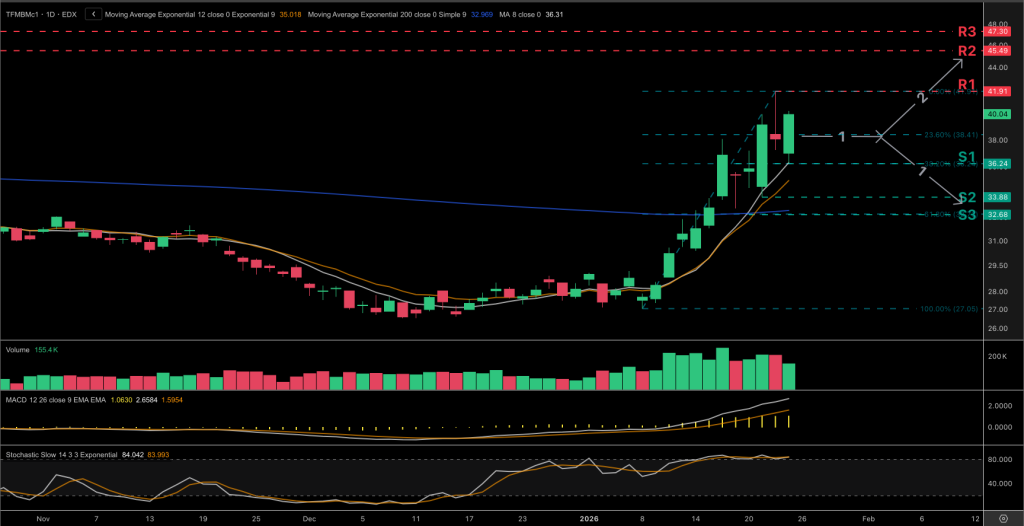

TTF Front Month gas outlook

- As expected, the bulls on the TTF front-month natural gas contract pushed sideways last Friday, failing to validate the bearish harami candle. Prices rebounded above the 38.2% Fib retracement at €36.24/MWh (S1) but volume was much weaker indicating mounting risks in peak bullish exhaustion.

- With the bull trend still strong on the Dutch natural gas hub, the 38.2% Fib retracement at €36.24/MWh (S1) is a key support that may see some dip buying supporting the sideways consolidation.

- In-house algos however suggest the market is entering a reversal zone despite the strong trend regime, limiting upside potential and making a corrective pullback the preferred scenario.

- A break below €36.24/MWh (S1) would likely trigger long covering toward the confluence support at €32.68/MWh (S3), where the 61.8% Fib retracement aligns with the 200-day EMA. In the process, the bearish harami will likely also be validated with a break below €33.88/MWh (S2).

- Traders on the Dutch gas market are advised not to chase the rally while some may look to fade strength near €41.91/MWh (R1) or on hourly timeframe.

Watch the full weekly analysis video here.

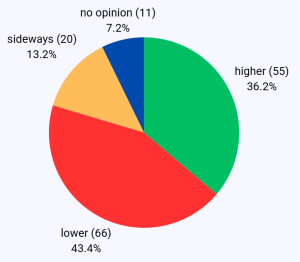

TTF Sentiment Benchmark

The bearish preference on the TTF front-month contract at the start of this week is also reflected in the chart setups. The bears are likely to pressure the market lower towards at least €36.24/MWh.

This is a change from the bullish sentiment from one week earlier.

Overall, a significant 36% of the market are still bullish inclined this Monday. It is unclear how many of those have active long positions. But even a small move lower this morning may force many long traders to close out, which would fuel the initial downleg.